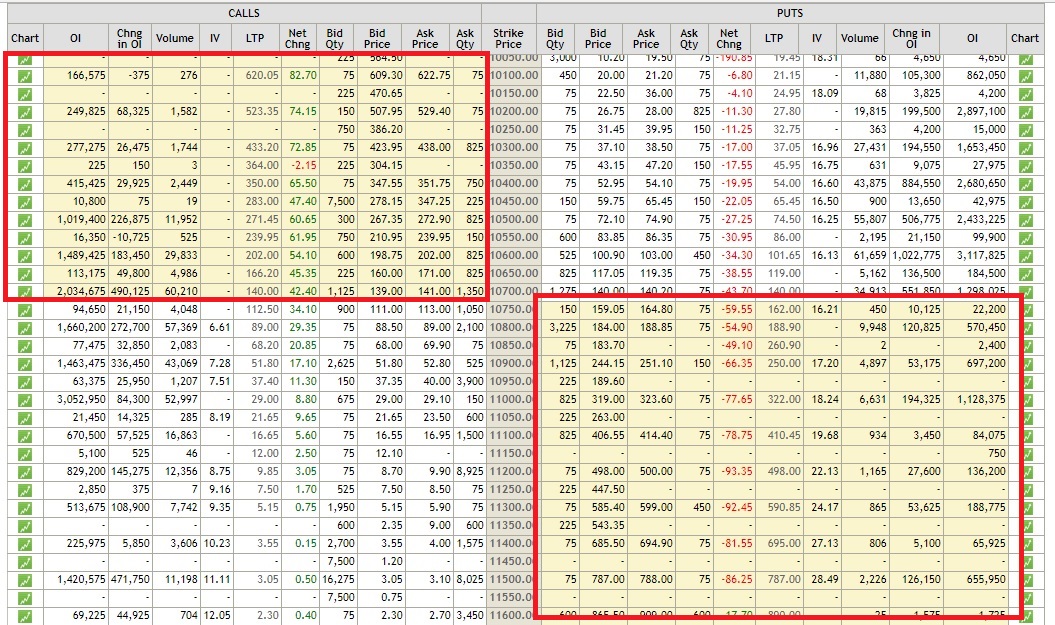

How To Read Option Chain On Nse

Mission Options Episode 9: In The Money (ITM), ATM (At The Money), OTM (Out of The Money) Explained with Examples. Which is better for Option Buying?Mission.

_121721.png)

The Ultimate Guide to Option Moneyness (ITM, OTM, & ATM)

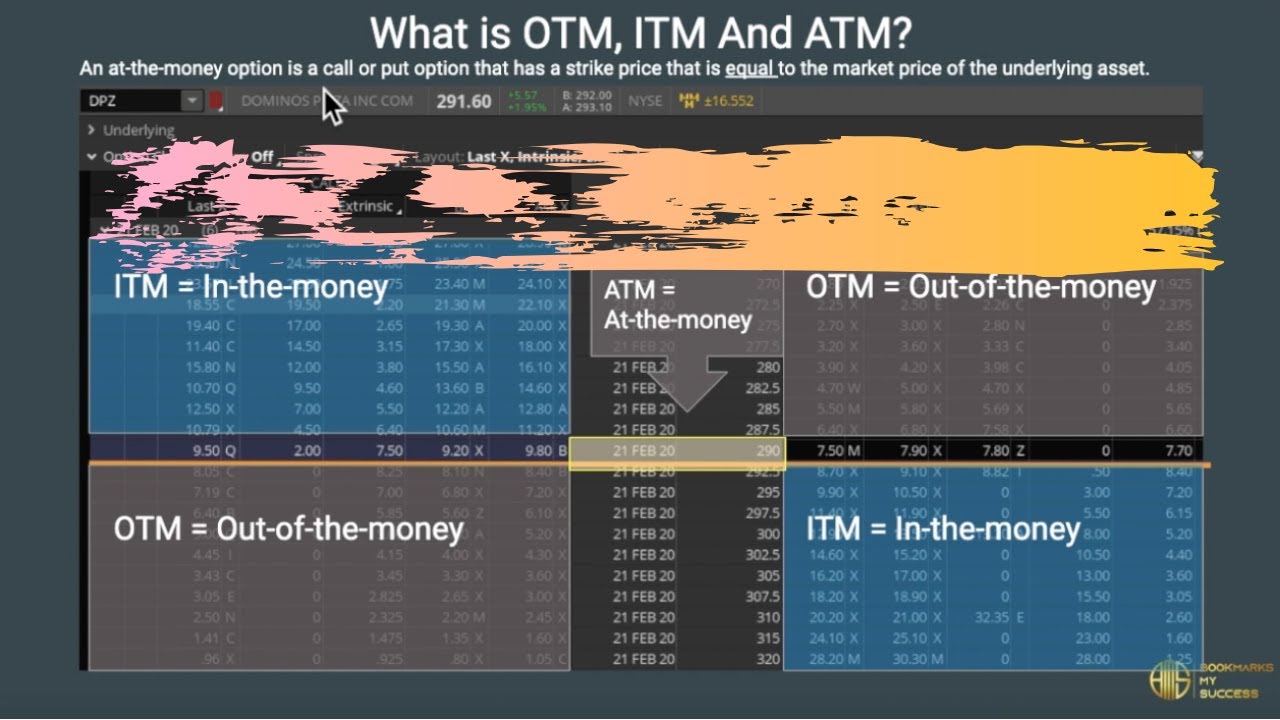

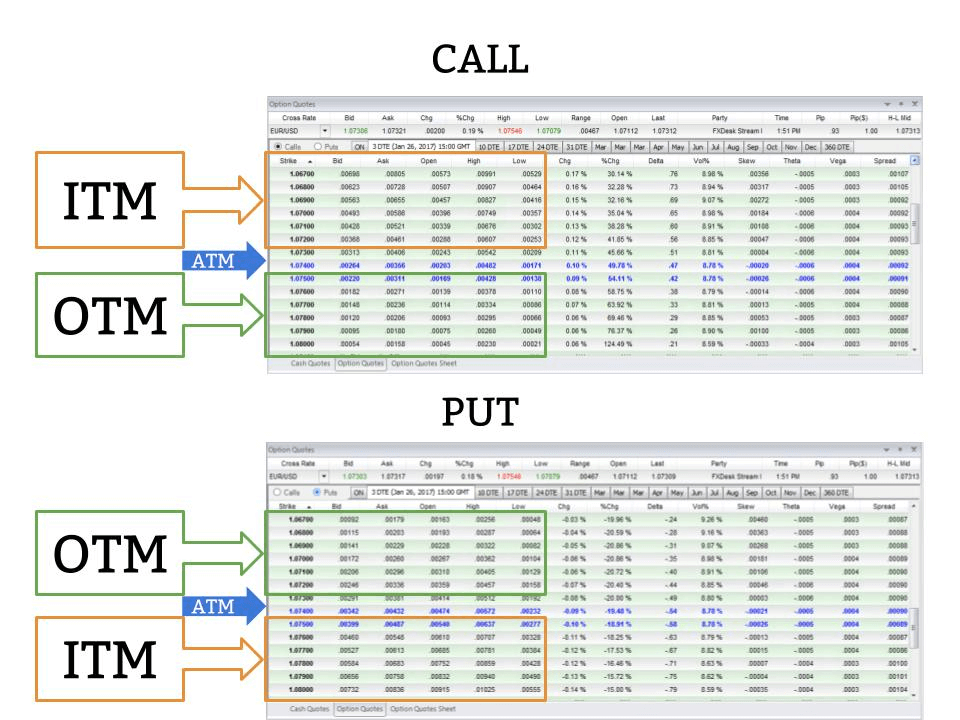

An option can be OTM, ITM, or at the money (ATM). An ATM option is one in which the strike price and price of the underlying are equal or very close to equal. Out of the Money Options You.

ATM ITM OTM YouTube

ATM: at-the-money OTM: out-of-the-money This is the short definition of these phrases and what they mean. To trade binary option contracts successfully, you need to understand each of these descriptions, what they mean in practice, and the various potential outcomes when you place an order.

What is OTM, ITM and ATM YouTube

You can describe an option as being 'in the money' (ITM), 'at the money' (ATM) or 'out of the money' (OTM). Learn more about it in this article. In, At and Out Of The Money Options (ITM, ATM + OTM)

otm atm itm in hindi option chain analysis hindi YouTube

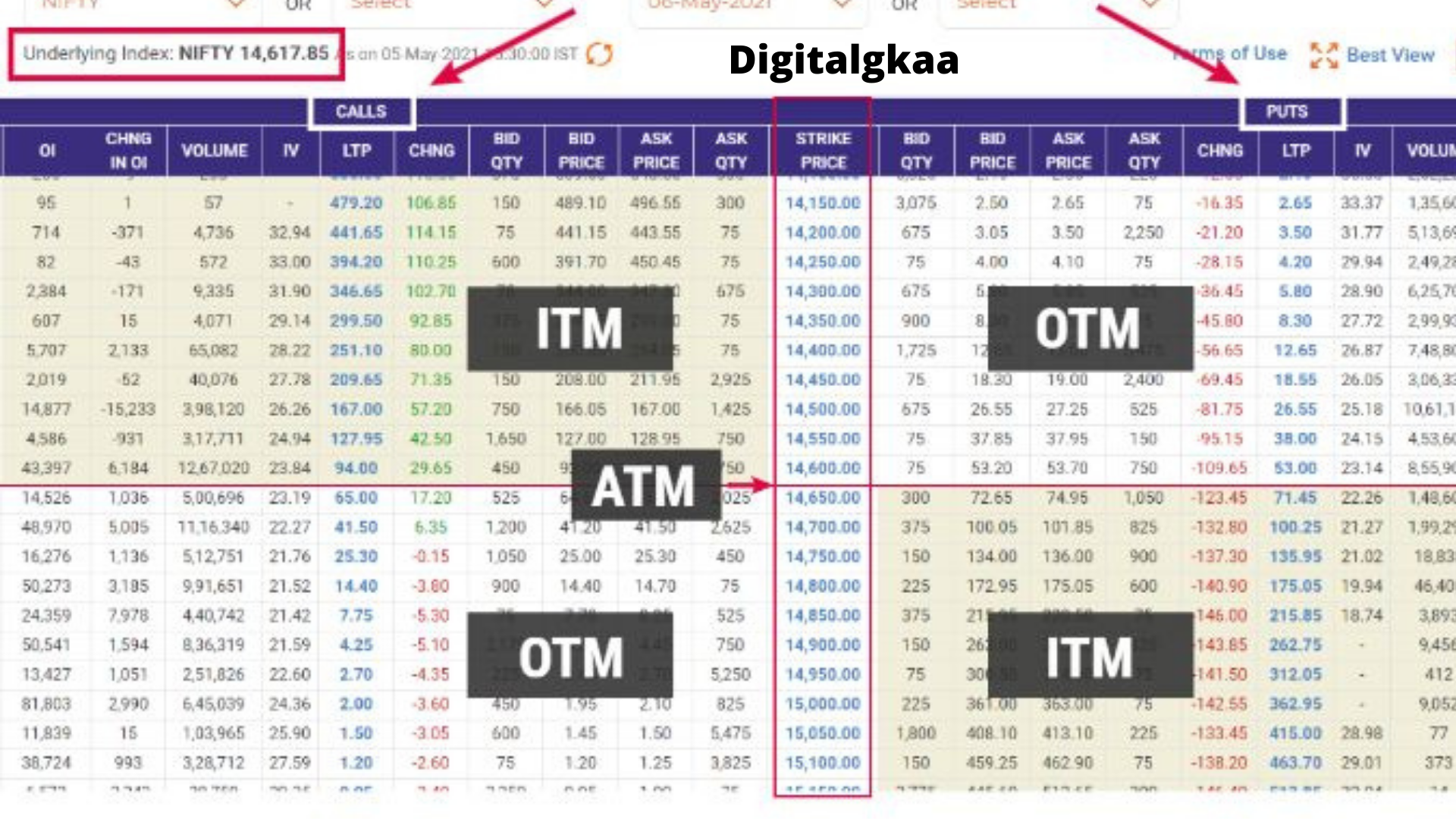

Likewise, it is called the 'Deep OTM' option when the intrinsic value is the least. The premiums for ITM options are always higher than the premiums for OTM options. The Option chain is a quick visualisation to understand which option strike is ITM, OTM, ATM (for both calls and puts), and other information relevant to options.

Opções ITM, ATM e OTM YouTube

At-The-Money (ATM) Options are ATM when the strike price and stock price are at the same level, whether you are trading calls or puts. It describes a price level parity between stock and strike prices. Determining the value of the option

ITM ATM OTM Options Explained in Hindi Option Moneyness or Option Pricing YouTube

The moneyness is classified into three categories namely, In-The-Money (ITM), At-The-Money (ATM) and Out-of-The-Money (OTM). You have to keep in mind that this intrinsic value will change as the spot price fluctuates. The calculation for intrinsic value differs for call option contract and put option contract.

What is ITM and OTM in Options in Hindi ITM vs OTM vs ATM क्या होता हैं? YouTube

In options trading, the difference between "in the money" (ITM) and "out of the money" (OTM) is a matter of the strike price's position relative to the market value of the underlying stock,.

What is ATM/OTM/ITM in Options? Dhan Blog

At the money (ATM), sometimes referred to as "on the money", is one of three terms used to describe the relationship between an option's strike price and the underlying security's price, also.

Options Moneyness (ITM, OTM, & ATM) The Complete Guide

The moneyness of an option contract is a classification method wherein each option (strike) gets classified as either - In the money (ITM), At the money (ATM), or Out of the money (OTM) option. This classification helps the trader to decide which strike to trade, given a particular circumstance in the market.

Pin on Options

Options: What is ATM, ITM, OTM? The strike price is the price at which a buyer of a call option can buy the security while for put options it is the price at which the security can be sold. The.

Moneyness Of Option Contract ITM ATM OTM Explained For Beginners With Easy Examples

1. At The Money (ATM) If you are wondering what is ATM, here is your answer. At The Money (ATM) option is an option contract whose strike price is closest to the spot price. Even if the strike price is the same as the spot price, it is considered an ATM option.

CALL Option definition Vanilla Options AvaTrade AU

An At-the-money put option is described as a put option whose strike price is approximately equal to the spot price of the underlying assets. From the following example, NIFTY FEB 8300 PUT would be an example of At-the-money put option, where the spot price is Rs. 8300.

ITM, ATM, OTM क्या होता है ? what is atm itm and otm explain in hindi

Option Moneyness (ITM, OTM, & ATM) Moneyness is used to describe an option contract's intrinsic value. An option's strike price is either in-the-money (ITM), out-of-the-money (OTM), or at-the-money (ATM). View risk disclosures. Options are classified into three different categories based on the relationship of the strike price to the underlying.

ITM, ATM, OTM क्या होता है ? what is atm itm and otm explain in hindi

ATM, ITM, and OTM Options Moneyness is used to describe the amount of intrinsic value for an options contract. Moneyness is described in three ways: in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM). View risk disclosures

What is Option Chain? ITM, OTM, ATM Explained DIGITALGKAA A Small Library for Learners

When comparing ITM vs OTM calls, the comparisons to the underlying are more intuitive than the comparisons of an ITM vs OTM put option.. For most rapid-growth strategies, the best contracts to buy will be either ITM or ATM options. That's because the movement of the underlying shares will have a greater impact on the price of the option.