N26 vs Revolut ¿Cuál es la mejor cuenta con tarjeta?

Quick Comparison On Trustpilot, Revolut has a rating of 4.3/5 based on 142k+ reviews, while N26 has a rating of 3.1/5 from 28k+ reviews. N26 is a solid choice for the convenient banking experience, while Revolut is an amazing option for travellers and open-banking enthusiasts.

N26 vs Revolut Which Card is Better?

The N26 Black card costs a little more per year than the Revolut Premium, with a difference of € 36. While through the N26 card you have unlimited cash withdrawals, Revolut only allows you to withdraw € 400 per month without charging. When traveling, Revolut offers coverage that extends for 40 days.

N26 versus Revolut how do they compare? bonkers.ie

Today I will be exposing the main relevant differences between 2 digital banking solutions, N26 and Revolut, because often I see people talking about both of.

N26 vs Revolut ¿Cuál es el mejor banco en diciembre 2023?

August 5, 2020. Dubbed as "challenger banks" not that long ago, the digital banks N26 and Revolut have acquired over 15 million registered users (10 million for Revolut and 5.5 million for N26) as of the first quarter of this year, putting both on a hyper-growth track. They also dominated headlines when they raised huge funding rounds in.

N26 vs Revolut — Która karta jest lepsza? Która jest tańsza N26 czy Revolut?

Exchange Rates N26 uses the Mastercard exchange rate with zero mark-ups for all foreign transactions and ATM withdrawals while Revolut uses the Interbank exchange rate with a 1% markup at weekends.

N26 vs Revolut My 8Point Comparison (2023)

Revolut. N26. Vaults: an ingenious money-saving feature offered by Revolut. When you use your card to make a purchase, Revolut will automatically round up the transaction to the nearest whole number and deposit the difference into your Vault. So, every time you buy a €2.80 coffee, €0.20 will be deposited into your Vault.

Revolut VS N26 ⇒ Quale Scegliere? Confronto e Differenze 2023

N26 uses a feature called CASH26, which lets you deposit anywhere between 50€ and 999€ within 24 hours and charges a 1.5% fee. On the other hand, Revolut doesn't charge fees when you deposit money into your account. N26 and Revolut have different withdrawal fee policies as well.

Revolut vs N26 What is the best online bank for you?

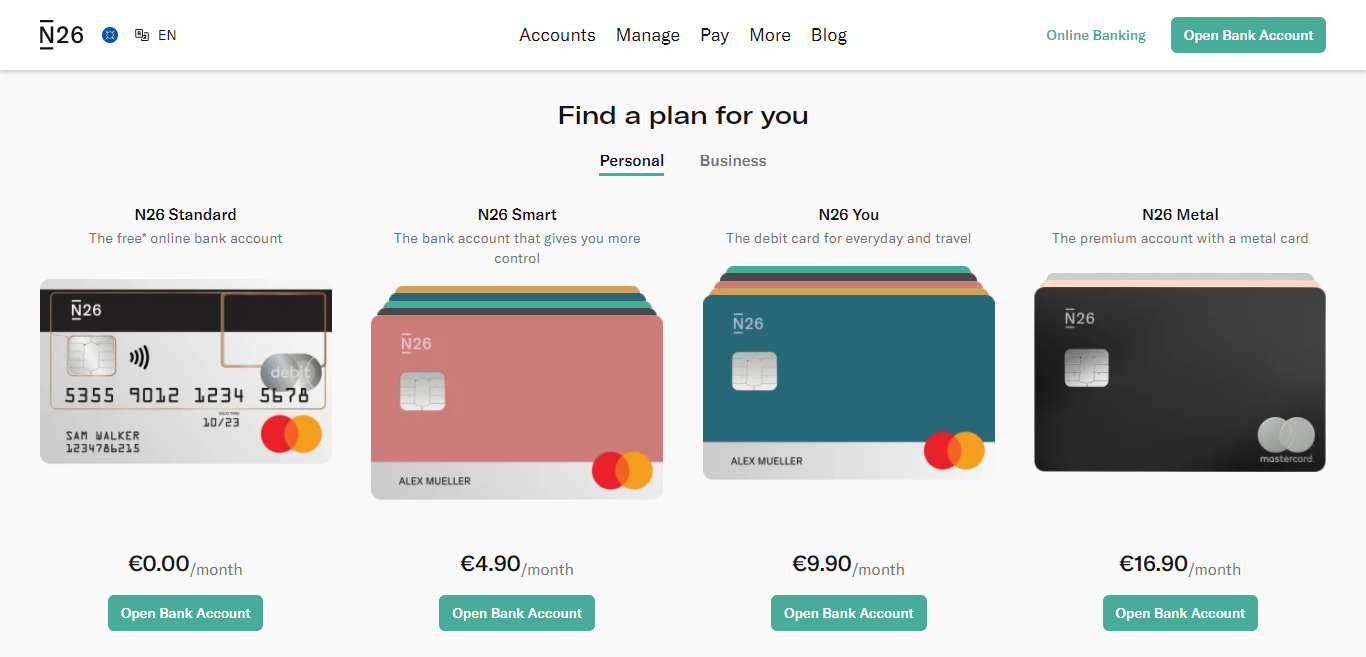

Features Availability & Customer Reviews Bottom line: What's better, N26 or Revolut? Frequently Asked Questions What is N26? N26 is a neobank based in Germany, which holds a full European banking license. You can open an N26 account in mainland Europe, but unfortunately, N26 accounts are no longer available for new customers in the US or the UK.

Revolut Premium vs N26 You comparatif des cartes premium

N26 is a full-featured bank account, whereas Revolut's primary product is its prepaid debit card and multi-currency capabilities (despite being a licensed bank, its banking services are significantly less specialized and fine-tuned than N26's). Furthermore, we solely compare the services' standard plans in this assessment, namely the.

CryptoMonnaie N26 vs REVOLUT ! CryptoFacile

Revolut vs N26 for frequent travelers Revolut. Revolut is a very good choice for anyone who travels a lot. This is because Revolut will not charge you on foreign exchange on all the major currencies for transactions not up to 1,000€ a month. For transactions more than 1,000€, a small 0.5% fee is charged.

N26 vs Revolut Standard comparatif des cartes gratuites

N26 vs Revolut (2023): The Battle of The Banks Which Bank Best Suits Your Needs? If you subscribe to a service from a link on this page, Reeves and Sons Limited may earn a commission. See our ethics statement. Rosie Greaves Author 15 min Updated: May 1, 2023

N26 vs Revolut (2023) The Battle of The Banks Platforms

Conclusion: N26 vs Revolut. After a thorough comparison of N26 and Revolut, it's clear that both digital banking giants have a lot to offer. Deciding which platform is right for you ultimately depends on your individual needs and preferences. Both N26 and Revolut offer impressive features and benefits, such as easy account opening, budgeting.

Revolut ou N26 quelle application de banque a la meilleure offre

What is Revolut? Founded in 2015, Revolut is a fintech company which much like N26, is what is known as a digital bank. The platform specializes in a range of banking services - including systems for cheap currency exchange.

N26 VS Revolut qual compensa mais? ComparaJá.pt

Go to Revolut The important bits Rates: N26 customers sending international transfers get the mid-market exchange rate. Revolut customers can get some currency exchange with the mid-market rate, although this may be capped for some account tiers Fees: Revolut and N26 both have either no-fee or fee paying accounts depending on the features you need

N26 vs Revolut le comparatif ultime

N26 Bank alternatives N26 vs Revolut. N26 Bank's closest competitor is Revolut, another European bank that is app-only and offers fee-free spending when abroad. N26 does however have a banking licence and although Revolut has had a banking licence approved, it is not yet able to operate as a fully-fledged bank.

N26 Metal vs Revolut Metal Quale Scegliere? Costi, Limiti e Vantaggi

N26 vs Revolut: Which Is Better? N26 vs Revolut 8.3 Winner Monito Score Trust & Credibility 7.9 Service & Quality 8.0 Fees & Exchange Rates 9.3 Customer Satisfaction 8.1 Go to N26 vs 8.6 Monito Score Trust & Credibility 8.9 Service & Quality 7.9 Fees & Exchange Rates 8.3 Customer Satisfaction 9.4 Go to Revolut